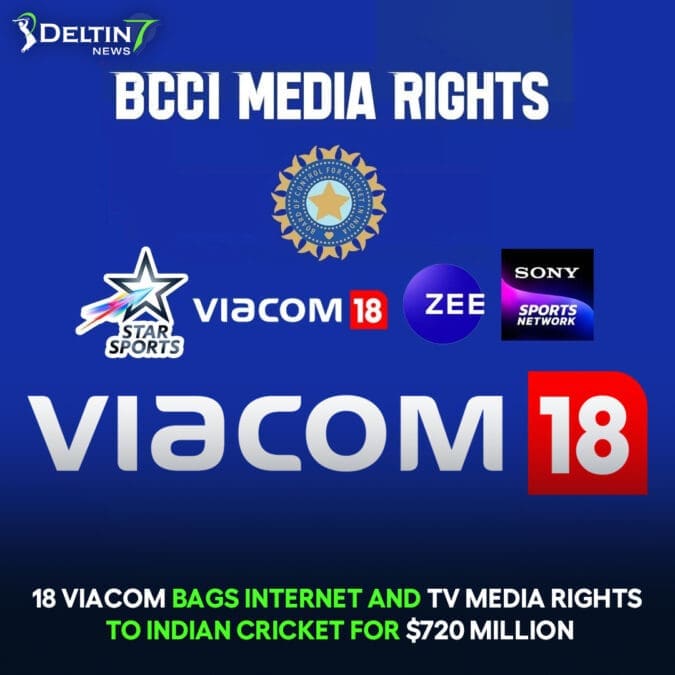

internet and TV media rights to Indian cricket for $720 million

Was the conflict over the media rights two-sided or three-sided? On August 28, Cricbuzz announced that Viacom 18, Disney Star, and Sony Sports would compete for the media rights after submitting proposals for the technical evaluation. But in the end, it was essentially a straight fight between Sony Sports (Culver Max Entertainment) and Viacom 18. The leaving rights holder, Disney Star, either chose not to participate in the negotiations or may not have done so actively.

As previously reported, the rights were sold for around INR 67.8 crore per game, yielding a five-year payout of Rs 5963 crore. This development could be the cause of one poor return. The presence of Disney Star, a large corporation that for more than ten years had essentially controlled Indian and international cricket, could have conceivably affected the final valuation. Disney Star, a company with its headquarters in California, declined to take part.

Disney Star seems hesitant in further investment after winning the ICC TV and digital rights (eventually sublicensed TV rights to Zee) for the following five years and IPL TV rights for another four years, Cricbuzz has learned. This choice may have been made due to instructions from their headquarters, which, according to a recent Wall Street Journal report, was averse to investing further money in cricket. With only Sony and Viacom left, Sony aggressively sought the television rights, resulting in a final offer of Rs 32.5 crore, a premium of Rs 12.5 crore, and more than 62 percent above the base price.

Industry insiders also point to significant turnover, a problematic concept in the context of digital platforms. This essentially refers to subscribers quitting the OTT platform after viewing a certain piece of content, even if they have subscribed for a whole year. The platforms’ biggest issue is keeping subscribers by continually delivering interesting content. Even while there is a lot of interest in Indian cricket, failing to deliver consistent material risks losing subscribers. Due to the loss of the IPL digital rights, Disney Hotstar, the digital arm of Disney Star, may have had substantial churn.

Although Star hasn’t made an official statement, a source in the industry speculates that their choice to abstain may have been motivated by dwindling viewership and financial worries. According to the source, Disney Star has repeatedly insisted that it will only take part in any offer for sports rights if doing so makes financial sense. They may have decided it was preferable to let the BCCI bilaterals rights go because to declining viewership, a jaded format, and the unavailability of important players for many matches.

Sony, meanwhile, politely accepted the outcome of the sale. “We extend our heartfelt congratulations to the BCCI for a transparent and effective e-bidding process and to the winners for securing the bilateral media rights,” said NP Singh, MD & CEO of Sony Pictures Networks India. Our methodical bid was supported by long-term growth objectives and market forecasts. We’re still committed to providing top-notch sporting entertainment despite the growing popularity of many sports genres.

Shortly after the winner of the media rights was revealed, rumors started to circulate that Viacom 18 would think about sub-licensing the television rights to Sony, much like how Star and Zee handled the ICC rights. Insiders claim that Viacom 18 aims to broadcast on both linear (Sports 18) and digital (Jio Cinema) platforms, thus this idea was quickly ruled out.

The agreement will go into effect in late September with a three-match one-day series and last through March 2028. The agreement covers 88 games, including 25 Tests, 27 ODIs, and 36 T20Is, as was already established. Additionally, it includes every local contest over the following five years as well as every match the Indian women’s teams play abroad.

Despite not owning the ICC rights, Jio’s acquisition of the rights places it in a significant position in the world of cricket media. This emphasizes the IPL’s position as the top cricket property even more. The final price of an international match is approximately half, if not exactly, that of an IPL match, which brings in Rs 118 crore for the Board of Control for Cricket in India (BCCI), the organization that oversees cricket in India.

A different viewpoint on the final sum is provided by Star’s prior contract cycle with the BCCI. An international match often has a total value of roughly INR 60 crore under the five-year MRA that was inked in 2018. In further specifics, however, Star was required to pay INR 46 crore each game in the first year, INR 47 crore in the second year, INR 46.5 crore in the third year, INR 77.4 crore in the fourth year, and INR 78.9 crore in the fifth and final year.

As a result, the penultimate international match in the previous cycle brought in Rs 78.9 crore for the BCCI, while the average this time is Rs 67.8 crore. Whether this is a substantial transaction or an undervaluation is up for debate, but in the end, everyone seemed satisfied, especially the BCCI.

“I am incredibly happy and immensely proud to see the BCCI brand develop so significantly. With today’s e-auction, BCCI has made a significant advancement in our quest and is now valued at the highest levels for per-match media rights. A cause that is very important to us is supporting grassroots cricket around the country with the money made from media rights. What counts most, according to BCCI secretary Jay Shah, is the legacy we leave behind and the good ripple effects we produce in our nation’s cricket environment.